EA表格

什么是EA表格?

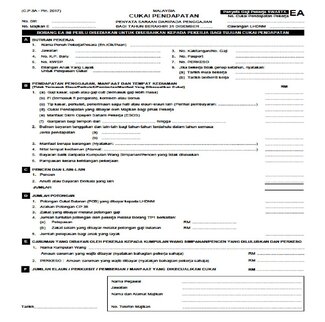

LHDN将EA表格定义为私人界员工的年度薪酬报表,其中包括他们过去一年的工资。EA表格确保您申报正确的收入和免税额度,并证明您是否符合需要缴税的工资等级。

根据《1967年所得税法》第83(1A)条,雇主必须在每年3月1日前提供和分发EA表格。没有的话,雇主可能会被罚款RM200至RM20,000令吉或不超过6个月的监禁,或两者兼施。

了解Borang EA/EA表格

- B1 (a)-(f): 薪酬、工资、休假工资、费用、佣金、奖金、福利、津贴、所得税、酬金

- B2: 收入的类型

- B3: 实物津贴(BIK)–非现金津贴,如提供住宿、公司汽车、司机、休假福利等。

- B4: 生活住宿价值(VOLA)

- B5: 未获批准的养老金/公积金的退款

- B6: 丧失工作补偿

注: 为了协助那些因Covid-19疫情而失去工作的纳税人,2020年和2021年的课税年度,单年服务的所得税豁免限额从10,000令吉提高到20,000令吉。

使用Kakitangan.com创建EA表格

Kakitangan.com帮助您顺利的地创建和分发准确的工资单和EA表格。

让我们管理您的薪资系统,为您解决这些麻烦事。

了解更多

常见问题(FAQ)